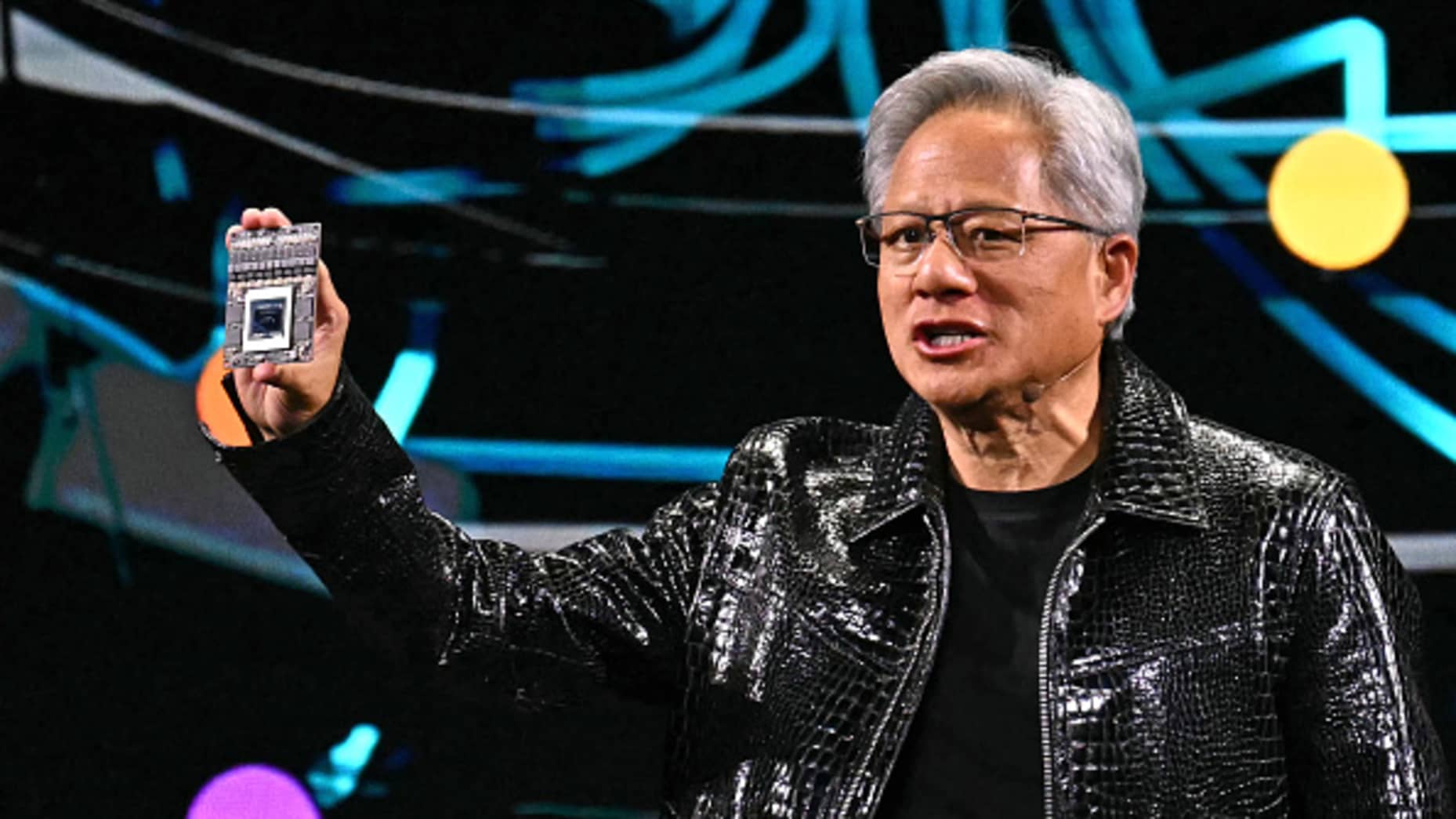

Nvidia chief executive Jensen Huang has publicly weighed in on the company’s delicate position in China amid fresh reporting of government scrutiny and ongoing geopolitical frictions, underscoring a cautious approach to a market that remains both critical and complicated for the world’s leading AI hardware supplier. His remarks come as the chipmaker navigates a shifting policy landscape, balancing revenue ambitions with the realities of national security concerns and regulatory oversight that have characterized the US-China technology dynamic for years. In London on the eve of a broader European engagement, Huang framed Nvidia’s China story as one of a long, sometimes turbulent engagement rather than a simple, scalable market, signaling both recognition of opportunity and acceptance of hard barriers that may persist.

Nvidia’s China narrative: disappointment, service to a market, and a roller coaster ride

Nvidia’s leadership has repeatedly underscored the gravity of China for the company’s global ambitions, yet the latest public remarks reveal a nuanced stance shaped by recent reporting and ongoing policy tensions. The Financial Times reported that China’s cyberspace regulator, the Cyberspace Administration of China, directed some of the country’s technology and internet platforms not to acquire Nvidia’s RTX Pro 6000D—a specialized GPU device designed for certain national applications. The implication, as framed by Huang, is that this development fits into a broader pattern of China’s selective procurement and market access that Nvidia has had to navigate.

Huang’s response was measured but pointed. He said he felt disappointed by what he described as constraints on a market in which Nvidia believes it has played a substantial role and contributed significantly relative to other nations. He reminded listeners that China represents a premium opportunity in the tech ecosystem—one that has a large, dynamic market and a historically vibrant technology industry. Yet even with such strength, he acknowledged that “they have larger agendas to work out between China and the United States,” and that Nvidia understands the political context shaping those agendas.

An important thread in Huang’s comments is his insistence that Nvidia has already made strategic choices about forecasting and disclosure in light of geopolitical realities. He indicated that the company has instructed financial analysts not to include China in forward-looking financial forecasts, explaining that outcomes in the Chinese market are likely to be governed by broader discussions between the US government and the Chinese authorities. This stance reflects a pragmatic risk management approach: Nvidia recognizes that the China portion of its business is not simply a function of direct sales or market demand, but a variable that could be influenced by regulatory changes, cross-border policies, and bilateral negotiations at the highest levels of government.

The metaphor Huang offered—describing the China operation as a “roller coaster”—captured the volatility that has characterized Nvidia’s engagement with the world’s second-largest economy in recent years. On the one hand, the company’s hardware and software ecosystem has found a ready audience among Chinese researchers, data centers, and AI developers seeking advanced accelerators for training and inference. On the other hand, export controls, licensing regimes, and policy shifts have introduced a landscape in which demand can be tempered by regulatory constraints, and where business certainty can be intermittent. Huang’s colleagues and investors have become accustomed to this pattern, recognizing that China’s market presents extraordinary potential but also significant political and regulatory risk that can rapidly reorient sales expectations and strategic priorities.

Another key point in Huang’s framing is the decision to exclude China from the base-case financial outlooks used for investor communications. He argued that the underlying dynamics of China’s market are so entangled with national policy and bilateral negotiation that they lie largely outside the scope of conventional corporate forecasting. The rationale is simple: if government decisions directly influence a core customer base or the conditions under which chips can be sold or deployed, those factors may not be reliably forecasted using standard market analysis. Nvidia’s leadership has argued that a meaningful projection would need to reflect the outcome of US-China policy dialogues and regulatory actions, which, by definition, are uncertain and subject to change based on strategic priorities in both capitals. This stance mirrors similar caution taken by other global tech players who operate in China and who must account for policy risk as a central element of strategic planning.

Huang’s broader message to stakeholders is that Nvidia remains committed to the China market insofar as it aligns with the country’s stated directions and opportunities. He emphasized the company’s long-standing service to Chinese industry, noting that Nvidia has supported the market for three decades and that its tools—ranging from GPUs to software frameworks and developer ecosystems—have been integral to China’s AI ambitions. Yet this commitment is framed within an awareness that China’s policies, strategic calculations, and competitive priorities are evolving, requiring a flexible, adaptive approach rather than a rigid, single-track strategy. While disappointing at the moment, Huang’s remarks also reflect a recognition that China’s decisions will be shaped by larger geopolitical negotiations, which Nvidia must acknowledge to sustain its long-term position.

In sum, Huang’s comments depict a mature, nuanced stance: Nvidia values China’s importance, has contributed extensively to its tech ecosystem, and intends to continue supporting Chinese developers and institutions in ways consistent with official intent and national policy. But he also stresses that the company’s strategic direction is inevitably tethered to the broader US-China policy environment, a reality that can shape opportunities in unpredictable ways. The “roller coaster” analogy, therefore, serves not only as a description of past fluctuations but also as a warning that future performance in China will hinge on policy alignment and bilateral negotiation outcomes. For Nvidia’s leadership, the challenge is to sustain product leadership and customer loyalty in a milieu where state-driven constraints can rapidly alter the calculus of demand, access, and utility.

This section of Nvidia’s public discourse thus centers on three interwoven themes: acknowledgement of China’s immense market potential, candor about the regulatory uncertainties that accompany that market, and a commitment to remain engaged in a way that aligns with both Chinese objectives and US policy guidance. Huang’s comments reflect a broader corporate instinct to balance growth ambitions with compliance imperatives and geopolitical realities. The near-term implication of this stance is that Nvidia’s investors should anticipate continued sensitivity to policy developments in Beijing and Washington, including potential licensing regimes, export controls, and procurement rules that could recalibrate how Nvidia sells its most advanced GPUs and associated technologies in China. At the same time, Nvidia’s history of innovation and its long-standing relationships with Chinese research institutions and enterprise users provide a foundation for a resilient presence, should policy conditions permit continued access and collaboration.

The broader significance of this section cannot be understated: Nvidia’s handling of China demonstrates how a global tech leader must manage expectations around a strategic market that can simultaneously drive growth and impose constraint. In this sense, Huang’s remarks are less a denial of China’s importance and more an articulation of a disciplined approach to market access. They underscore the reality that global supply chains and AI ecosystems are inextricably linked to political decisions, and that corporate strategy must be designed to thrive under a spectrum of possible regulatory outcomes. As Nvidia continues to invest in product development, developer ecosystems, and customer engagement in China, the company’s leadership will likely emphasize transparency with investors about policy risk, while highlighting the resilience of its technology platform and the depth of its engagement with Chinese tech communities. This dynamic—where business opportunity and regulatory risk co-exist—will remain a defining feature of Nvidia’s China strategy in the years ahead, shaping how the company negotiates, adapts, and ultimately sustains its presence in one of the world’s most important AI markets.

Export controls, licensing, and the geopolitics of AI hardware

The conversation around Nvidia’s China strategy is inseparable from the broader policy framework governing export controls and technology transfers that have defined, and continue to define, the global AI tech landscape. The United States has long scrutinized the export of advanced AI chips and related software to China, citing national security concerns and potential applications that might alter military or strategic balance. The regulatory environment has evolved through a sequence of policy actions and licensing regimes that directly affect Nvidia’s ability to sell, ship, and deploy some of its most capable hardware in China. The tension between enabling competitive AI capabilities and addressing national security concerns has created a complex backdrop for Nvidia’s China operations, and Huang’s remarks — while emphasizing the company’s commitment to serving the Chinese market — sit squarely within this larger policy discourse.

Historically, the United States has restricted the export of a range of AI chips to China, including some of Nvidia’s server-grade accelerators, on the basis that these products could be leveraged to accelerate state-backed AI initiatives with potential military or socio-political implications. The existence of such restrictions implies that Nvidia’s China strategy is not merely a function of market demand or customer relationships, but also a function of regulatory permission. The regulatory framework has included licensing provisions that govern how shipments, technology transfers, and foreign direct sales can occur, with compliance requirements that can change as geopolitical calculations shift. In practice, this means Nvidia must carefully align its product plans, licensing arrangements, and customer engagements with the evolving policy environment in Washington and Beijing. The company’s strategy to not include China in baseline financial forecasts is also reflective of this reality, acknowledging that policy changes can create abrupt movements in the company’s ability to serve or price for the Chinese market.

A notable episode in this policy landscape occurred in August, when the White House reportedly reached an agreement with Nvidia that granted export licenses under specific terms. The terms, as described, included a provision whereby 15% of Chinese sales of a particular Nvidia product, the H20 server chip, would be redirected to the U.S. government as part of the deal’s compensation for export access. While the exact mechanics and implications of such licensing arrangements require careful legal interpretation, the essential point for Nvidia is that the policy framework has continued to influence the company’s export strategy and revenue mix. The handshake between corporate leadership and government policy signals that Nvidia is willing to engage with regulatory authorities to facilitate market access, albeit under conditions that may limit or shape the commercial model. The broader implication for Nvidia’s long-term strategy is that policy risk is now a formal dimension of market planning, and that the company will need to adapt its product portfolio, pricing, and channel strategy to align with any licensing constraints or changes in export policy.

In this context, the China policy environment interacts with other global concerns—most notably the US government’s broader approach to technology decoupling and supply chain resilience. Nvidia’s leadership has consistently argued for maintaining robust, global, multi-sourced AI ecosystems that support a broad base of customers across regions, while also recognizing that geopolitical tensions constrain decision-making. The licensing regime associated with H20 serves as a concrete example of how policy can drive a portion of the revenue from a critical market toward a government entity, reframing the way many investors think about the economics of China-related sales. It also underscores the potential for policy to create a path-dependent dynamic: Nvidia may secure access through licenses today, but those licenses may be contingent on ongoing policy negotiations, bilateral policy shifts, or new security assessments in the future. As a result, Nvidia’s China strategy will need to remain adaptable, with contingency plans for alternative markets or product configurations should access to certain chips be restricted for extended periods.

The export controls and licensing narrative also tie into broader questions about how companies like Nvidia navigate the delicate balance between innovation, national security concerns, and the aspirations of rapidly growing AI ecosystems in China. On one hand, there is a compelling business case for providing Chinese organizations with cutting-edge hardware and software that can accelerate scientific discoveries, industry modernization, and AI-driven productivity. On the other hand, the policy framework seeks to ensure that sensitive technologies are not diverted in ways that could undermine security or strategic interests. Nvidia’s leadership has signaled a willingness to work within this framework, highlighting that market access comes with obligations and that the company is prepared to adjust to regulatory expectations. For policymakers, Nvidia’s experience provides a real-world example of how advanced hardware suppliers can operate in an environment characterized by dual-use concerns and strategic competition, which may inform future regulatory calibrations, licensing reforms, or bilateral dialogues intended to clarify gray areas and reduce uncertainty for business planning.

In practical terms, Nvidia’s export-control regime, licensing arrangements, and China strategy collectively shape the company’s near-term revenue trajectory and long-term strategic posture. They influence product development roadmaps, the design of regional sales and service teams, and the level of investment required to sustain local partnerships and developer ecosystems. They also affect investor sentiment, as the risk-adjusted return calculus for China-related business must now factor in policy risk, licensing timelines, and the potential for sudden shifts in access that cannot easily be hedged by conventional marketing or sales strategies. The policy environment thus acts as both constraint and driver: constraint in the sense that access to the Chinese market can be limited by licensing and national security considerations, and driver in that the very challenge of navigating this landscape encourages Nvidia to innovate in areas such as software-enabled acceleration, cloud strategy, and collaborative AI research models that may be less sensitive to export controls. The evolving policy environment will therefore continue to be a critical determinant of Nvidia’s China strategy, guiding executives as they weigh pricing, partnerships, and product offerings in a way that aligns with both commercial objectives and regulatory expectations.

The interplay between export controls and market strategy also highlights the importance of transparent, predictable governance in maintaining confidence among developers, enterprises, and researchers who rely on Nvidia’s technology for AI research and deployment. In an environment where policy decisions can abruptly alter the feasibility of certain sales or licensing arrangements, Nvidia’s emphasis on open dialogue with policymakers and a commitment to responsible stewardship of its technology becomes a strategic asset. It signals to customers and partners that the company seeks to balance ambition with accountability, a signal that may help sustain long-term partnerships even amid policy uncertainty. As Nvidia continues to operate across multiple jurisdictions, it will likely pursue a multi-layered approach that includes diversified product lines, alternative licensing pathways, and targeted collaborations that can survive policy shifts while keeping the core AI platform at the center of its value proposition. The end result is a company that remains strategically nimble, capable of managing risk while pursuing growth in AI across global markets, including China, under a framework that respects security concerns and geopolitical realities.

Antitrust scrutiny and regulatory risk surrounding the Mellanox acquisition

In addition to the ongoing export-control considerations, Nvidia’s China and broader operations have faced regulatory attention from antitrust authorities amid the company’s past acquisition activity. Specifically, China’s State Administration for Market Regulation has opened an anti-monopoly investigation into Nvidia in connection with its acquisition of Mellanox, the Israeli technology firm that builds advanced network solutions for data centers and servers. This development signals a more comprehensive level of scrutiny of Nvidia’s market power and its acquisitions from a Chinese regulatory standpoint, reflecting broader government concerns about competition, market concentration, and the potential implications for local players and the overall market structure in which Nvidia operates.

From a business perspective, an anti-monopoly review in China can carry meaningful implications for Nvidia’s China strategy. If regulators determine that the Mellanox deal, or Nvidia’s broader combining of products and capabilities, raises competitive concerns, the company could face remedies, such as divestitures, behavioral restrictions, or other measures designed to restore balance within the market. Such outcomes, while not necessarily foreclosing Nvidia’s continued presence in China, could impose additional compliance costs, alter product configurations, or complicate the integration of Mellanox’s network solutions with Nvidia’s own GPU and software offerings. This regulatory development also intersects with the broader policy and geopolitical landscape by reinforcing the reality that major AI and data-center players operate under a complex web of regulatory checks that extend beyond export controls to include competition policy and market structure considerations.

The Mellanox investigation has a broader strategic resonance for Nvidia. It underscores the theme that the Chinese government, like regulators in other major markets, is attentive to how large technology platforms consolidate power, control critical infrastructure components, and shape the competitive dynamics of the data-center ecosystem. For Nvidia, this means that engaging with Chinese authorities on competition issues is likely to be a recurring aspect of its regulatory dialogue, one that may require ongoing commitments to transparency, fair competition, and the preservation of market access pathways for other players. The company’s leadership has historically framed such scrutiny as part of the normal course of doing business in a world with strong emphasis on national policy and domestic industry protection. Still, the reality remains that any adverse regulatory outcome could influence Nvidia’s China strategy, potentially affecting customer procurement decisions, channel strategies, or even the timing and sequencing of product rollouts in the region.

In the immediate term, Nvidia’s response to the antitrust inquiry is likely to emphasize cooperation with regulators, a commitment to compliance, and a continued focus on delivering technology that supports a broad base of Chinese and global customers. The Mellanox integration remains an important strategic asset for Nvidia’s data-center solutions, and the company would likely seek to address any concerns through technical, financial, or operational disclosures that reassure regulators about its competitive dynamics and the overall impact on the market. The broader takeaway is that regulatory risk is becoming an increasingly important dimension of Nvidia’s China strategy, adding another layer of complexity to how the company designs its product families, engages with customers, and navigates market access in a landscape where antitrust policy is actively used as a tool of economic governance. For investors and industry observers, the Mellanox investigation is a reminder that the AI hardware market sits at the nexus of technology leadership and regulatory oversight, a space where strategic decisions must account for both innovation potential and competitive safeguards.

Global AI investment push: UK expansion, geopolitical signaling, and the broader tech ecosystem

Beyond regulatory and market-access dynamics, Nvidia has actively signaled its intention to invest in AI infrastructure in key global hubs, with the United Kingdom standing out as a focal point of expansion. The company announced a substantial commitment to the UK’s AI ecosystem, totaling about £11 billion (roughly $15 billion) in investments intended to bolster AI infrastructure, research capabilities, and the broader ecosystem that underpins next-generation AI development. This level of investment aligns Nvidia with a wide cohort of American and international tech giants that have underscored the UK’s potential as a strategic node in the global AI landscape. It reflects a recognition of the country’s deep talent pool, robust university research community, and a regulatory environment that, while rigorous, is perceived as conducive to innovative, large-scale tech deployments.

The UK AI infrastructure push is not an isolated act; it sits within a broader pattern of major U.S. tech companies, including Microsoft, Google, and Salesforce, announcing multibillion-dollar investments in the country. These moves collectively signal a coordinated, high-profile effort to accelerate Britain’s AI capabilities, data-processing capacity, and digital economy transformation. Nvidia’s contribution—part of a larger ecosystem-building endeavor—signals its intent to deepen collaborations with UK industry players, research institutions, and enterprise customers, as well as to establish a foothold that could facilitate technology transfer, workforce development, and local manufacturing or assembly capabilities that reduce latency and increase service reliability for customers across Europe and beyond.

In parallel with the UK investment narrative, Nvidia’s leadership indicated that the broader geopolitical landscape remains a critical backdrop for corporate strategy. Huang has been accompanying then-President Trump on a state visit to the United Kingdom, a juxtaposition that underscores the intricate interplay between technology policy, international diplomacy, and economic strategies in a highly fractious global environment. While it is not uncommon for U.S. tech leaders to engage with policymakers and leaders from other nations during such visits, the alliance of high-profile tech investment and political leadership sends a clear signal about the importance of AI as a strategic economic and national security priority. The presence of Nvidia alongside other tech giants during this high-profile period illustrates how private-sector capabilities are increasingly embedded in a broader policy and diplomatic agenda, with AI infrastructure projects serving as both economic accelerants and instruments of soft power.

Nvidia’s UK initiative also reflects a broader belief in the resilience and potential of the European AI stack. While the European market has its own regulatory intricacies, including framework conditions around data privacy, interoperability, and governance of AI systems, the UK investment demonstrates a willingness to deploy capital in a way that fosters local capabilities, while creating a blueprint that could be replicated in other regions. This approach—invest first in infrastructure, cultivate talent, and then scale deployments across Europe and other markets—aligns with Nvidia’s overarching strategy of building a globally connected AI ecosystem. In practice, UK AI infrastructure investments could serve as a proving ground for new hardware configurations, software platforms, and developer tools that are optimized for local conditions, while also enabling cross-border collaboration across Europe’s research community and industry partners. The result is a more diversified global footprint that helps Nvidia hedge against market-specific risks and leverage regional growth opportunities, even as it must navigate policy frictions and export-control considerations in other markets.

Huang’s statements about China’s AI sector, in this context, acquire additional resonance. He acknowledged that the Chinese market is large and vibrant, and that its technology industry has benefited from three decades of Nvidia involvement. This reinforces a dual message: Nvidia sees China as a long-term strategic partner in AI advancement, and it recognizes that geopolitical realities require a balanced approach that prioritizes responsible collaboration with both Chinese authorities and the U.S. government. The UK investment, the presence of Nvidia on a high-profile state visit, and the broader wave of investments by major Western AI players collectively reflect a shared strategic aim: to strengthen AI infrastructure, champion innovation across global markets, and ensure that the development of AI capabilities remains anchored in competitive, well-governed, and widely accessible ecosystems. This is to say, Nvidia’s global AI strategy is not solely about selling more GPUs; it is about shaping an entire infrastructure stack—hardware, software, services, and policy engagement—that can support scalable AI across diverse regulatory and economic contexts.

The cross-polarization of investments and policy alignment raises questions about how Nvidia and similar firms will manage the tensions between access to Chinese markets and Western concerns over security and strategic competitiveness. On the one hand, Nvidia’s ongoing commitments to China and the Chinese AI ecosystem speak to a recognition that the region remains a major driver of AI breakthroughs and enterprise adoption, with state-backed initiatives and large-scale data-center deployments creating demand for advanced accelerators. On the other hand, policy constraints and licensing regimes in the U.S. and other Western markets will continue to place a premium on careful navigation of cross-border technology flows. Nvidia’s UK strategy, therefore, must be viewed as both an expansion plan and a risk-management framework that seeks to preserve a global supply chain while cultivating regulatory and market conditions that maximize long-term value creation for shareholders and stakeholders alike.

Investors will watch how Nvidia balances these concurrent priorities in the coming quarters. The company’s capacity to innovate and deliver world-leading GPU and software platforms—along with its ability to establish key partnerships, sustain a robust developer ecosystem, and maintain a constructive dialogue with policymakers—will be central determinants of its competitive positioning. Nvidia’s UK investment agenda signals confidence in the longer-term growth of AI infrastructure in Europe, even as the firm navigates ongoing policy debates and potential export-control modifications that could affect cross-border technology transfers. In combination with its China strategy and the policy dynamics surrounding Mellanox and other acquisitions, the UK push illustrates how Nvidia is pursuing a multi-pronged global expansion that seeks to solidify its leadership in AI while acknowledging the uncertainties that shape global technology governance.

China’s AI sector, policy ambiguity, and Nvidia’s long-term commitment

Huang’s remarks about the Chinese AI sector underscore a persistent tension at the heart of Nvidia’s global strategy: the country remains a crucial engine of AI innovation and deployment, but the political climate—shaped by competitive dynamics, regulatory oversight, and bilateral policy frictions—puts a premium on careful risk management and strategic flexibility. The Chinese market’s scale and dynamism have historically made it a central horizon for Nvidia’s technology strategy, with a broad user base spanning universities, research institutions, cloud providers, and enterprise data centers. The fact that Nvidia has emphasized “30 years” of service in China signals a long-running collaboration that has borne fruit in the form of AI research progress, product adoption, and ecosystem development.

Yet Huang’s comments also highlight the reality that geopolitical considerations can shift the trajectory of that collaboration. When a government signals restrictions on specific purchases or procurement channels, companies must weigh not only current demand but also the probability of continued access under unpredictable policy regimes. In such an environment, Nvidia’s approach—keeping the Chinese market within reach while ensuring that its broader strategy remains compliant with national policies—reflects an attempt to preserve strategic flexibility. The company’s leadership argues that supporting the Chinese market is aligned with its mission to enable AI progress globally, and that doing so should be done in a manner consistent with the interests of both the Chinese authorities and the U.S. government.

This framing inevitably invites discussion about the nature of mutual dependence in the AI ecosystem. China’s AI sector benefits from access to sophisticated hardware accelerators, development tools, and software ecosystems that Nvidia provides. This access accelerates scientific collaboration, industry adoption of AI, and the growth of domestic AI capabilities, which in turn fuels demand for Nvidia’s platforms. Conversely, Nvidia must operate within policy constraints that can limit or shape how, when, and where such devices are deployed. The interplay between market demand and regulatory risk means that Nvidia’s China strategy must be built on a foundational commitment to product excellence, customer success, and compliance, with a readiness to adjust its approach as policies evolve. The company’s stated preference for ongoing support of both its Chinese partners and the U.S. government reflects a broader corporate philosophy that places governance, compliance, and societal impact at the center of its long-term strategy.

From a public-relations and investor-relations perspective, Nvidia’s messaging around China is carefully calibrated to acknowledge the market’s significance while setting reasonable expectations about near-term access and growth. Huang’s language about larger agendas and the understanding of those dynamics signals to investors that the company is prioritizing a sober, policy-informed view rather than optimistic, policy-agnostic projections. This approach can be interpreted as a form of risk management aimed at avoiding mispricing in market forecasts and ensuring that the company’s narrative remains aligned with the realities of geopolitics. It also reinforces the idea that Nvidia’s China strategy will be driven as much by policy resolution as by sales opportunities, a stance that could influence how investors evaluate the company’s risk-adjusted return profile in the short and medium term.

The broader question raised by these developments is whether China will continue to be a growth engine for Nvidia, or whether policy dynamics will impose constraints that necessitate a reconfiguration of the company’s regional focus and product strategies. If policy alignment improves, Nvidia could realize stronger access for its advanced GPUs, software platforms, and developer tools, enabling more expansive deployment of AI across Chinese data centers and enterprises. If, conversely, policy tensions intensify, Nvidia might accelerate diversification toward other markets, or pivot toward more software-centric solutions that can operate within the policy parameters established by regulators. The existing strategy is positioned to accommodate either outcome, but the path toward sustained growth will depend on how China’s and the United States’ policymakers address issues surrounding security, technology transfer, and competition policy in the AI era.

In this context, Huang’s remarks illuminate a broader strategic framework: Nvidia seeks to be a global platform provider that can enable AI progress across regions while staying within the boundaries set by national sovereignty and security concerns. The future of Nvidia’s China engagement, and of the broader AI hardware ecosystem in China, will thus depend on ongoing policy dialogues, licensing arrangements, and bilateral cooperation that can foster a more predictable, stable environment for technology exchange. The company’s ongoing collaboration with Chinese researchers, its investments in regional AI capabilities, and its willingness to adapt to regulatory changes will be critical in determining whether Nvidia can sustain a robust, high-growth China operation over the next decade.

Strategic implications for Nvidia’s global posture and investor outlook

The confluence of policy developments, regulatory scrutiny, and global investment initiatives has substantial implications for Nvidia’s strategic posture and how investors evaluate the company’s future trajectory. In the short term, policy uncertainty surrounding export controls, licensing arrangements, and antitrust reviews can create volatility in sentiment and complicate revenue forecasting for China-centric product lines. Nvidia’s management has responded to this environment with a nuanced approach: it remains committed to China’s AI ecosystem and its users while maintaining a cautious stance about market access and forecasting that accounts for the influence of geopolitical decisions on business outcomes. This approach may help mitigate investor concerns by signaling that Nvidia recognizes and manages risk rather than relying on optimistic assumptions about a policy-free growth path.

In the medium to longer term, the company’s proactive engagement with regulatory authorities, its strategy to diversify investment across critical markets such as the United Kingdom, and its ongoing emphasis on collaboration with global partners position Nvidia to navigate a world where AI is becoming an essential strategic resource for nations and industries. The UK investment, which is substantial in scale, serves not only as a capital commitment but also as a signal of the company’s intent to foster a thriving AI ecosystem outside of the United States and China. This broader geographic diversification helps dampen the impact of any single jurisdiction’s policy shifts on Nvidia’s overall revenue and strategic momentum, while simultaneously reinforcing the company’s reputation as a global leader in AI hardware and software.

However, a balanced assessment must also consider the potential downside risks. The combination of export-control pressures, regulatory investigations, and cross-border political tensions could introduce a longer-term constraint on Nvidia’s ability to capitalize on the full value of its product portfolio in certain markets. If regulatory outcomes constrain access to core hardware platforms or complicate the monetization of advanced AI chips in China or other regions, Nvidia may need to recalibrate pricing, adjust product roadmaps, or accelerate the adoption of alternative growth vectors such as software-enabled AI services, cloud-based offerings, or enhanced partnerships with domestic players in other jurisdictions. The company’s ability to pivot swiftly and effectively will be a key determinant of its resilience and sustained leadership in the AI hardware market.

From an investor-relations perspective, Nvidia’s communications around China, licensing, and antitrust matters will likely emphasize the company’s long-term value proposition: a world-leading AI platform that powers a broad spectrum of customers, from university researchers to enterprise data centers, across multiple geographies. The narrative will stress resilience, continuous innovation, and a disciplined risk-management approach that balances growth with governance. This message should be reinforced by transparent disclosure of policy developments, licensing arrangements, and any adjustments to product strategy in response to regulatory changes. Investors will expect a coherent, evidence-based articulation of how policy dynamics could affect revenue streams, margins, and capital allocation decisions, along with credible scenarios for how Nvidia would optimize its global footprint under various policy outcomes.

As Nvidia continues to execute its multi-regional strategy, several questions will shape the near-to-mid-term discourse: Will policy alignment between the US and China improve enough to restore greater market access for Nvidia’s most advanced accelerators in the Chinese market? How will licensing regimes evolve in the face of ongoing national security concerns and global technology competition? To what extent will Nvidia’s UK and broader European investments translate into sustained growth in AI infrastructure and ecosystem development, and how will this intersect with regulatory frameworks across Europe? What additional steps will Nvidia take to ensure competitive parity with other integrated AI platform providers that are racing to build comprehensive, multi-region AI stacks? These questions will guide investor expectations and the company’s strategic communications as it advances in a rapidly evolving AI economy.

The broader ecosystem implications are equally consequential. Nvidia’s approach to China, licensing, and global expansion interacts with the strategies of other technology leaders who are racing to build AI platforms that can compete on both performance and governance grounds. The convergence of hardware innovation, software ecosystems, and policy evolution will shape how AI infrastructure evolves over the next decade. Nvidia’s performance, therefore, will depend not only on its engineering prowess but also on its ability to navigate a complex regulatory and political environment while sustaining strong customer partnerships and developer ecosystems. The company’s capacity to harmonize these dimensions will influence its market leadership, the pace of AI-driven innovation, and the broader trajectory of the AI hardware market in which Nvidia operates.

Conclusion

In the wake of ongoing policy debates, regulatory scrutiny, and a global race to scale AI, Nvidia’s leadership has framed the China relationship as a long-term, risk-managed engagement that acknowledges both the market’s immense potential and the political realities that influence access and growth. Huang’s remarks—emphasizing both disappointment at present constraints and understanding of broader geopolitical agendas, while reaffirming a deep commitment to China’s AI ecosystem and a continued partnership with the U.S. government—reflect a pragmatic approach to a complex, high-stakes environment. The company’s export-control dynamics, including licensing arrangements tied to specific products, and the antitrust review related to Mellanox, add layers of regulatory complexity that Nvidia must address while pursuing innovation and growth. The UK investment push and the broader wave of multibillion-dollar AI commitments by major tech players highlight a shared belief in the importance of AI infrastructure as a driver of economic and technological progress across regions, even as policymakers navigate competition, security, and governance considerations.

Looking ahead, Nvidia’s strategy will likely center on maintaining leadership in GPU performance and software tooling while expanding its global footprint through targeted investments in key markets like the United Kingdom, Europe, and other centers of AI talent. The company’s China strategy will be tested by the evolving policy landscape, and Nvidia’s success will depend on its ability to align with Beijing’s regulatory expectations while preserving access channels that enable its core products to reach Chinese researchers and enterprises. The Mellanox regulatory review will continue to be a variable that could shape the company’s market structure and competitive dynamics, prompting ongoing dialogue with regulators and a strategic approach to compliance.

Overall, Nvidia’s trajectory underscores the intricate balance that modern tech behemoths must strike in a geopolitically charged era. As AI becomes ever more central to economic growth and national strategy, companies like Nvidia will operate at the intersection of innovation and policy, navigating market opportunities and constraints with a view toward sustainable, responsible leadership in a globally connected AI ecosystem. The next chapters in Nvidia’s China story will depend on the outcomes of policy negotiations, regulatory decisions, and the company’s continuing ability to deliver world-class hardware, software, and developer ecosystems that empower AI progress while respecting the governance frameworks that shape the global technology landscape.