Intel CEO Lip-Bu Tan hosts a high-stakes moment in the evolving U.S. technology landscape as fresh political friction and strategic corporate decisions intersect. A recent meeting between the semiconductor industry’s leadership and top government officials underscored the delicate balance Washington seeks to strike between nurturing American chip manufacturing and addressing national security concerns tied to global supply chains. In the wake of public scrutiny over Tan’s ties to China and his past leadership at Cadence Design, market reactions remained keenly aware of how executive posture and policy shifts could influence Intel’s trajectory in a fiercely competitive AI hardware race dominated by Nvidia and others. The dialogue also highlighted a broader pattern: U.S. policymakers leaning into direct engagement with corporate leadership to align business strategy with national security and economic objectives while navigating evolving international rivalries.

The meeting and its significance in a charged policy moment

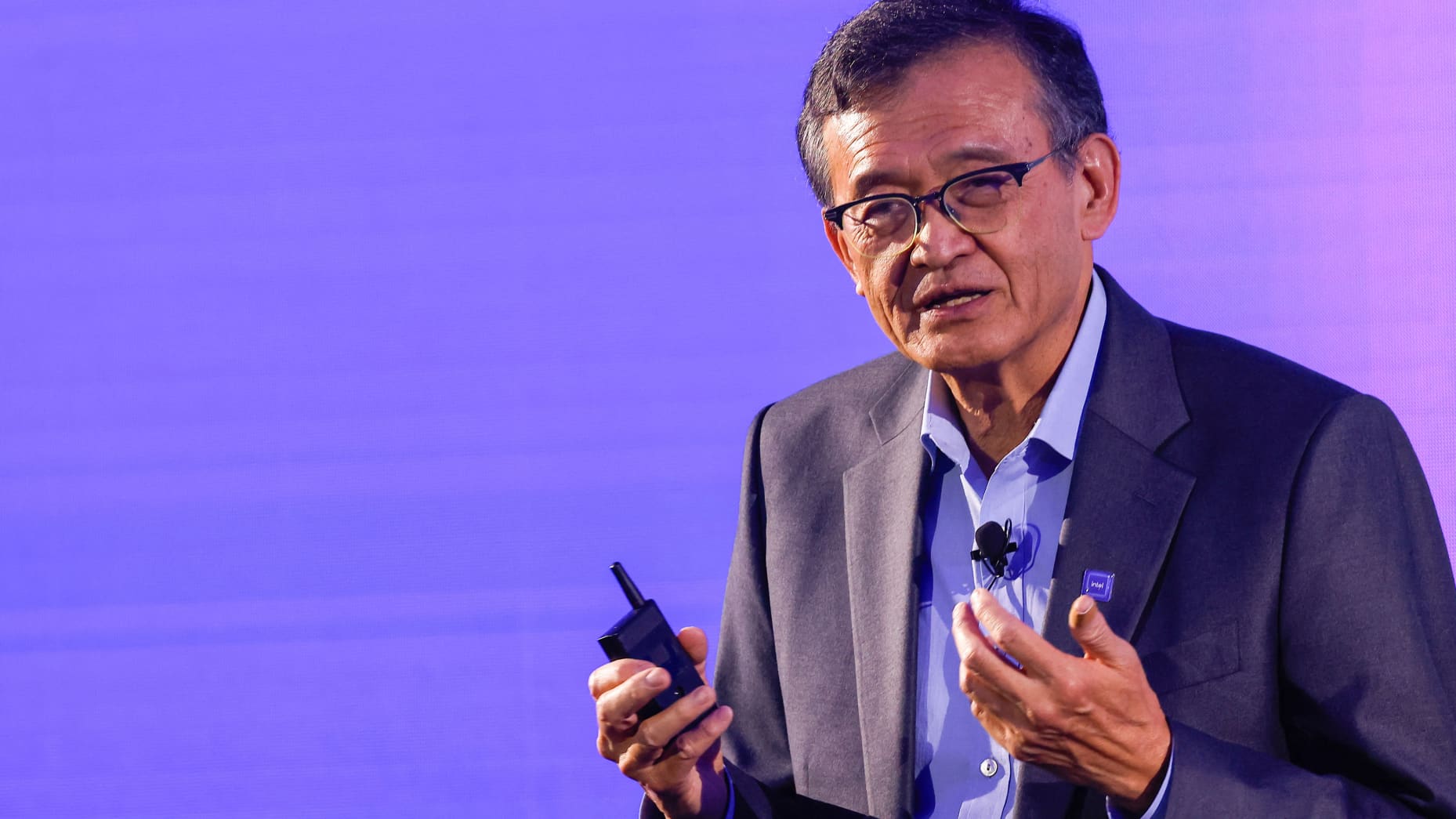

The encounter brought together Lip-Bu Tan, the chief executive officer of Intel and a longtime industry veteran who had previously served as a director since 2022, with a delegation that reportedly included the Secretary of Commerce and the Secretary of the Treasury, alongside the sitting U.S. president’s social-media-based outreach. The gathering appeared to mark a notable shift in tone from public, sharp scrutiny to a more deliberative, candid exchange about how Intel could advance resilience in domestic technology and manufacturing capabilities. Observers noted that the discussion focused on strategic initiatives to bolster U.S. leadership across core sectors critical to national security and economic vitality, including process innovation, supply chain diversification, and the political economy surrounding advanced semiconductor production.

In the immediate aftermath, corporate communications from Intel emphasized a strong, enduring commitment to strengthening the nation’s technological base and securing a competitive edge for American manufacturing. The company’s statements framed the dialogue as a constructive exchange aimed at aligning corporate efforts with national policy priorities, while reinforcing that the board and Tan were fully invested in the broader aim of advancing U.S. interests in technology leadership. Market participants reflected the sentiment, with Intel stock showing a positive multi-day drift even as the broader macro environment remained complex for hardware companies facing demand fluctuations, capital expenditure pressures, and ongoing competition in AI accelerators and foundry services.

It is worth noting that the context surrounding the meeting included prior inquiries from lawmakers about Tan’s possible ties to China, particularly given his leadership tenure at Cadence Design, which prompted questions about whether he would divest from positions linked to the Chinese state or its allies in the technology ecosystem. The specifics of those concerns underscored the heightened sensitivity around leadership appointments at major U.S. technology firms, where corporate governance, national security considerations, and geopolitical risk converge. The public discussion around these questions did not diminish the reported willingness of both sides to engage in dialogue, but it did underscore a fraught backdrop in which strategic corporate decisions are evaluated through a national-security lens as well as a financial-performance lens.

The broader takeaway from the announced engagement was a signal that the administration seeks to directly involve executives in shaping policy implementation, particularly in industries deemed vital to economic security and global competitiveness. The nuanced nature of the conversation—covering long-term investment strategy, workforce development, and the balancing of domestic capacity with international dependencies—reflects a new paradigm in which public-private collaboration is essential for a sector as strategically critical as semiconductors. The fact that the administration’s approach appears to be evolving—from pressure for leadership changes to coordinated planning—suggests a more complex governance dynamic that could influence corporate risk assessment and strategic planning for years to come.

Lip-Bu Tan: leadership background, role, and challenges at Intel

Lip-Bu Tan’s rise to the executive helm at Intel marked a pivotal inflection point for a company navigating a difficult transition in a market increasingly dominated by specialized AI accelerators and large-scale foundry ecosystems. Born in Malaysia and raised in Singapore before migrating to the United States, Tan is an industrial executive whose career trajectory has spanned diverse technology leadership roles. His educational path, including an advanced degree from a premier engineering institution, has shaped his approach to engineering-centric governance and strategic risk management. When he assumed the position of chief executive, he inherited a company in the midst of restructuring, with corrective actions including workforce adjustments and strategic revisions to its manufacturing footprint and capital allocation.

Under Tan’s leadership, Intel pursued a reorientation toward its core competencies in process technology, the optimization of its manufacturing network, and a renewed emphasis on the company’s ability to compete in the high-stakes AI and data-center segments. Early remarks from the new leadership indicated a candid understanding that turning the company around would demand time, patience, and a disciplined focus on operational improvements. He acknowledged the need to address structural issues that had impeded execution, including the ability to scale foundry capabilities and to align product roadmaps with customer demand and the rapidly evolving AI landscape.

The transition at the top followed a period of turbulence within Intel’s corporate structure, particularly as the company faced intensified competition from Nvidia’s dominance in AI hardware and momentum in the AICompute market. In this environment, Tan’s strategy emphasized a more aggressive approach to cost management, workforce optimization, and a renewed emphasis on profitable growth areas while being mindful of the company’s long-run objective to reassert leadership in U.S. technology and manufacturing excellence. Even as he faced internal skepticism and external scrutiny tied to his past roles, his public statements after taking the helm stressed the importance of patience and deliberate steps to fix the business, suggesting a leadership philosophy rooted in measured, transparent execution rather than abrupt, radical changes.

The governance implications of Tan’s tenure included balancing his dual responsibilities as chief executive and a member of the board with sensitive questions about potential conflicts of interest arising from past executive roles at other tech firms with international exposure. These considerations mirror a broader pattern in which U.S. technology leadership is increasingly linked to scrutiny about ties to foreign entities, especially those with restricted or sensitive connections to state-driven initiatives. Tan’s leadership also highlighted the strategic imperative to accelerate Intel’s transition toward a more robust foundry-focused business model, to bolster domestic manufacturing capabilities, and to look for pathways to regain momentum in an AI-centric market where capital expenditure, R&D investment, and time-to-market play decisive roles in securing market share and profitability.

In public communications, Tan has framed the transformation as a long-term effort—one that requires patience and a disciplined sequence of actions. He acknowledged that early months in the top job involved difficult decisions, including workforce reductions and structural adjustments within Intel’s foundry division. He described those measures as necessary steps toward stabilizing the company and positioning it for sustainable growth, even as the broader semiconductor sector underwent a period of intense competition and strategic recalibration. His remarks suggested a leadership style oriented toward accountability, clarity of purpose, and a willingness to confront tough tradeoffs as Intel sought to rebuild credibility with customers, investors, and policymakers.

Within this context, Tan’s narrative has been closely watched for signals about Intel’s strategic direction—whether the company would double down on legacy processes and capacity, or pursue a more radical reinvention through new process nodes, additional manufacturing sites, and expanded partnerships. The decisions around manufacturing site plans, including proposed projects in Europe, underscored a broader strategic debate about the optimal geographic footprint for advanced semiconductor production, supply chain resilience, and the political implications of siting significant capital investments overseas. The leadership challenge, therefore, extended beyond technical considerations to encompass corporate diplomacy, stakeholder alignment, and the capacity to articulate a coherent plan that could win backing from customers, suppliers, and government partners while maintaining financial discipline.

The China-ties scrutiny, Cadence link, and the broader geopolitical backdrop

The scrutiny surrounding Lip-Bu Tan’s ties to China—arising in part from his leadership tenure at Cadence Design, a prominent EDA (electronic design automation) company—illustrates the intensified attention paid by lawmakers and regulators to how executive networks and prior affiliations may influence strategic decision-making in a global supply chain. The concerns reflect a broader U.S. policy focus on ensuring that leadership at major technology firms does not present conflicts that could undermine national security or align with adversarial interests. In this environment, lawmakers have raised questions about whether corporate leadership must divest from positions within companies or entities connected to sensitive sectors or to actors considered potentially misaligned with U.S. geopolitical objectives.

The Cadence episode provided a focal point for national-security discussions around whether leadership shifts might be used as a mechanism to ensure alignment with strategic objectives as the United States seeks to preserve a competitive edge in critical technologies. While industry watchers acknowledged the legitimate concerns about governance and risk management, the evolving dynamic between private sector leadership and public policy also highlighted the complexity of balancing corporate autonomy with national-interest considerations. As such, the discourse around Tan’s past affiliations did not function in isolation; it was embedded within a wider conversation about how principal executives’ professional histories intersect with the strategic priorities of a country attempting to maintain technological superiority in the face of rising competition from Chinese and other non-U.S. players.

The political discourse surrounding China in the tech sector has grown increasingly nuanced. It spans concerns about technology transfer, supply chain dependencies, and access to advanced manufacturing capabilities that could influence global leadership in AI and related fields. In this climate, the administration has pursued a more assertive stance—partly through policy tools like export controls, investment screening, and targeted licensing regimes—to shape how much American and allied technology can be deployed domestically and abroad. These policy instruments carry implications for both the domestic economy and international customers who rely on Intel and its peers for advanced semiconductors and design tooling. The interplay between corporate governance, regulatory oversight, and national strategy is thus a defining feature of the current semiconductor landscape, with leadership decisions in one company resonating across an ecosystem of suppliers, competitors, and policymakers.

The Trump administration’s public communications around Intel—particularly around leadership and governance—also illustrate a broader pattern of direct presidential engagement with key industry leaders. The interplay between presidential guidance, cabinet-level involvement, and corporate strategy signals a willingness to leverage high-level political capital to influence corporate behavior in service of strategic objectives, including the strengthening of U.S. supply chains and the protection of critical technologies. In that sense, the situation reflects a complex governance model in which private sector decision-makers operate under heightened political visibility, with potential implications for how Intel negotiates with customers, competes on price and performance, and plans long-term investments in research, development, and manufacturing capacity.

This environment also frames the public perception of leadership changes and strategic decisions at Intel. Investors and observers weigh how Tan’s leadership style, past affiliations, and the company’s response to national-security concerns could affect Intel’s credibility with customers who depend on stable supply and predictable performance in a volatile geopolitical calendar. The tension between safeguarding national interests and maintaining open markets for competitive global technology remains a core driver of policy and corporate strategy, and Intel’s leadership decisions occur against this backdrop with potential ripple effects for the broader semiconductor ecosystem.

Nvidia, export controls, and the U.S. technology competition arc

The broader policy and market context is shaped by the United States’ assertive stance toward China in the realm of advanced computing and AI hardware. In this environment, Nvidia’s recent licensing arrangement—part of an overarching framework guiding export controls—illustrates how policy instruments are deployed to regulate access to sensitive technologies. The settlement, which involved a licensing framework that allows controlled access to certain high-performance computing capabilities for China and related entities, reflected a negotiated balance between enabling continued commercial activity in a way that aligns with national security objectives and maintaining a competitive edge for American hardware developers.

The narrative around export control licenses and licensing negotiations also intersected with statements made by President Trump concerning Nvidia’s sales to China. The president described a bargaining position in which he proposed a higher percentage cut in sales did not come to fruition, ultimately resulting in a negotiated reduction that both acknowledged the strategic concerns on the policy front and avoided an abrupt disruption to business operations. The outcome signaled a nuanced approach to export controls—where policy aims to curb the most sensitive technology transfers while allowing channels for legitimate commerce to continue in a tightly regulated manner. This balance is central to how the United States seeks to maintain leverage in advanced semiconductor markets while ensuring that domestic innovation remains resilient and robust.

From a market perspective, Nvidia’s licensing arrangements and the broader policy framework contributed to a shifting landscape for AI accelerators and the ecosystem surrounding chip manufacturing and intellectual property. The discussions around export controls highlighted how government policy can directly impact the competitive dynamics among leading semiconductor firms. While Nvidia continues to enjoy a dominant position in AI hardware, the policy environment requires ongoing navigation to maintain access to global markets, particularly for parts and technologies that are sensitive from a national-security viewpoint. The ongoing dialogue between policymakers and industry leaders is thus a critical element of the strategic context in which both Nvidia and Intel operate, influencing decisions on product roadmaps, supply-chain diversification, and investment in domestic foundry capabilities.

This dynamic is further complicated by the political emphasis on national security, economic security, and supply-chain resilience. The strategic calculus for American chipmakers involves not only the performance and efficiency of their products but also their ability to operate within a policy framework that constrains certain international interactions. The Nvidia case thus serves as a concrete example of how policy tools—export controls, licensing regimes, and potential future adjustments—shape the operating environment for leading semiconductor firms. It underscores the reality that technological leadership in AI and related fields is deeply entangled with policy decisions at the highest levels of government, and that firms must plan for multiple contingencies as policy direction shifts.

The intersection of policy and business strategy is particularly salient when considering Intel’s own strategic maneuvering. As the company transitions under Tan’s leadership toward a more robust U.S.-centric manufacturing footprint and a stronger emphasis on domestic innovation, it must navigate the same policy winds that are reshaping the broader sector. Intel’s decisions about investment, site selection, and capacity expansion will be influenced by regulatory signals, export controls, and the evolving calculus of collaboration with U.S. government agencies. In this sense, the Nvidia and export-control narrative is not simply about one company or one policy move; it is about a structural shift in how advanced semiconductor capability is governed on the global stage, and how U.S. industry leaders position themselves within a policy-driven economy that prizes both security and growth.

Intel’s strategic positioning, capabilities, and near-term actions under Tan

The leadership change at Intel coincided with a broader corporate effort to re-establish momentum in a market where the AI computing paradigm has become a central battleground. Tan’s remarks and the company’s strategic communications emphasized a reorientation toward strengthening U.S. technology leadership and national economic security through enhanced domestic manufacturing capabilities and strengthened collaboration with government and industry partners. In practice, what this entails includes a closer alignment of product roadmaps with national priorities, sharpened execution on cost control and capital allocation, and a renewed focus on a manufacturing strategy that aims to close gaps that had previously allowed rivals to gain an edge in AI-ready silicon.

Early after the leadership transition, Intel signaled a willingness to recalibrate its long-term investments in manufacturing sites and to adjust expectations around the company’s immediate development timeline. In public discussions with analysts, Tan highlighted the complexity of turning around a large-scale manufacturing powerhouse in a market where the competitive dynamics are intensely shaped by process technology, yields, and the ability to scale complex foundry networks. He acknowledged that the path forward would require patience and disciplined progress, while simultaneously laying the groundwork for more aggressive steps in later years as the reset took hold. The underlying message was clear: Intel would pursue a more deliberate strategy to restore competitiveness in AI-enabled workloads while maintaining a diversified portfolio in client, data-center, and emerging compute segments.

As part of this strategic recalibration, Intel canceled or reevaluated some ambitious manufacturing plans in Europe, including proposed sites in Germany and Poland, and it signaled that progress would be re-timed in Ohio as the company refined its production and capital-commitment profiles. The concurrent emphasis on cost discipline and workforce alignment reflected a broader challenge for a large, historically growth-oriented company: to balance ambitious expansion with the need to preserve cash flow and ensure a sustainable return on investment. Tan’s leadership thus faced the dual challenge of meeting near-term profitability targets while maintaining a credible, long-run vision for the company’s role in the U.S. technological ecosystem. Analysts and investors watched closely for signals about how Intel would reallocate resources to optimize process technologies, supply chain robustness, and strategic partnerships that could accelerate its ability to compete in AI and data-center markets dominated by more nimble players or those with stronger scale advantages.

In concrete terms, Intel’s management under Tan focused on several core priorities. First, improving operational efficiency across the manufacturing network to reduce burn rate and optimize capital deployment. Second, advancing process technology and product pipelines that could deliver competitive advantages in performance-per-watt and compute density. Third, renewing the investment narrative around U.S.-centric production ecosystems—an objective aligned with national policy and industry priorities—while maintaining a global supply chain capable of meeting diverse customer needs. Fourth, strengthening partnerships with key customers and ecosystem players to ensure that Intel’s offerings align with the rapidly evolving requirements of AI workloads, from inference to training to hyperscale deployments. The net effect of these priorities was a strategic shift toward reinforcing Intel’s relevance in a high-stakes market at the intersection of hardware innovation and national security considerations.

Market responses to these strategic adjustments included moderate stock performance movements and cautious optimism about the company’s ability to reestablish momentum in critical segments. The broader market backdrop—characterized by a mixed macroeconomic environment and ongoing volatility in technology equities—meant that investors evaluated Intel’s strategic clarity and execution potential alongside the sector’s other dynamics, such as supply chain resilience, customer confidence, and regulatory risk. The company’s earnings trajectory and capital outlook would be closely watched as indicators of whether the reorientation toward U.S. manufacturing and domestic innovation could translate into meaningful improvements in profitability and market share over time. The dialogue around Tan’s leadership and the plan for Intel’s transformation thus sits at the intersection of corporate governance, technology strategy, and national policy—an intersection that will shape Intel’s path for years to come as it navigates a challenging but pivotal period for the semiconductor industry.

The broader economic, policy, and market implications for the sector

The conversations surrounding high-level leadership decisions at Intel, together with the evolving administrative approach to technology policy, reveal a sector where national strategy and corporate strategy increasingly overlap. U.S. policy has placed a premium on building a resilient domestic semiconductor ecosystem—one capable of sustaining innovation, securing critical manufacturing capacity, and reducing exposure to geopolitical risks. The administration’s posture toward the semiconductor supply chain—balancing export controls, investment frameworks, and regulatory oversight—reflects a long-term plan to maintain competitive parity with global peers while safeguarding national security interests. In this climate, the Intel leadership transition is interpreted not merely as a corporate personnel shift but as a data point in the broader strategic alignment between the private sector and government.

The Nvidia licensing case, along with the broader export-control regime, illustrates the policy tools at work in shaping the global distribution of technology and the strategic choices facing leading chipmakers. This environment obliges Intel and other major players to factor policy risk into their investment calendars, research priorities, and market-entry strategies. Companies must weigh the opportunities presented by global demand for AI acceleration against the need to comply with licensing requirements and policy constraints that could alter the pace and scope of international collaboration. The net effect is a more dynamic and potentially risk-aware operating context, in which leadership decisions—such as those made by Tan—must be evaluated not only on financial metrics but also on their alignment with national priorities, security considerations, and the geopolitical realities that define modern technology competition.

From an investor and market-structure perspective, the sector faces meaningful uncertainty around how policy evolution will influence supply chains, capital expenditure, and capacity deployment. The semiconductor industry is notably sensitive to shifts in policy posture, with potential implications for customer relationships, contract manufacturing, and long-term strategic partnerships between U.S.-based producers and global customers. In such an environment, Intel’s emphasis on strengthening U.S. technology leadership and domestic manufacturing aligns with a broader strategic objective to calibrate production capacity closer to core markets and to reduce vulnerability to external shocks. This approach, if executed effectively, could yield gains in reliability and supply-chain resiliency, even as near-term profitability and speed of execution remain subject to the challenges inherent in transforming a large, legacy manufacturing powerhouse.

The leadership transition and the policy context also carry implications for workforce strategy and regional development. Intel’s decisions about site planning, regional investments, and workforce training are central to the country’s ability to cultivate the next generation of engineers, technicians, and researchers who will advance semiconductor technology and related fields. As the company realigns its strategy toward more sustainable growth, it also contributes to the broader narrative about how the United States can attract and retain top talent in a globally competitive landscape. The interplay of government incentives, corporate investment, and education and training programs will therefore continue to influence the sector’s trajectory, shaping the capabilities that underpin future breakthroughs in AI hardware and beyond.

Overall, the period described by these developments illustrates a sector at a crossroads: where the urgency of national security imperatives intersects with the imperative for sustained, innovation-led growth. The leadership decisions at Intel, the regulatory environment, and the competitive dynamics with Nvidia and other global players all contribute to a complex, multifaceted picture of where the semiconductor industry is headed. As policy directions mature and market players adjust their strategies, Intel’s path under Lip-Bu Tan will be watched as a bellwether for how U.S. technology leadership seeks to maintain prominence in the age of AI, hyperscale computing, and a highly connected global economy.

Timeline, milestones, and what to watch next

In the near term, investors and industry observers will be looking for tangible milestones that demonstrate progress on Intel’s strategic priorities. These milestones include the execution of the company’s revised manufacturing plan, the advancement of process technology, and the achievement of milestones in cost efficiency and capital discipline. The company’s communication about its progress in the foundry division and its ability to balance layoffs with growth investments will also be critical indicators of how well Tan’s leadership is translating rhetoric into measurable outcomes. The timing of site decisions, production ramp-ups, and capital allocation plans will be scrutinized as signals of the company’s readiness to re-enter a leadership position in AI-enabled compute workloads.

Additionally, policy developments will remain a key driver of market sentiment and strategic planning. Any changes to export-control regimes, licensing criteria, or government funding programs for domestic semiconductor manufacturing could alter the calculus for Intel’s investment priorities, potentially accelerating or delaying certain projects. The interplay between regulatory developments and corporate execution will thus continue to define the environment in which Intel operates, shaping its competitiveness, risk profile, and capacity to deliver on its long-term strategic objectives.

Another important area to monitor is the broader ecosystem of semiconductor innovation, including technology licensing, partnerships with design and manufacturing service providers, and collaborations with academic and national-laboratory programs that support advanced process development. Intel’s ability to forge effective collaborations, win favorable contract terms, and align its technology roadmap with customer demand will influence its capacity to close the gap with Nvidia and other leading AI hardware providers. The company’s public messaging around patience and disciplined pacing suggests a willingness to take the time necessary to rebuild core capabilities, but the market will demand visible improvements in product performance, manufacturing efficiency, and revenue growth to sustain confidence.

As the industry approaches a critical inflection point in AI compute capabilities, leadership decisions at Intel will be interpreted in the context of a much larger strategic calculus about how the United States maintains competitiveness in a high-stakes, technology-driven global economy. The balance between safeguarding national interests and fostering a vibrant, open market for innovation will continue to shape not only Intel’s destiny but also the broader trajectory of the semiconductor sector, with potential ripple effects for customers, suppliers, policymakers, and investors around the world.

Conclusion

The encounter between Intel’s Lip-Bu Tan and top government officials, set against a backdrop of heightened scrutiny over ties to China and strategic pressures from global competitors, underscores how leadership and policy are interwoven in today’s semiconductor landscape. Tan’s ascent to the CEO role, followed by renewed dialogue about U.S. technology leadership, highlights a moment in which corporate governance, national security considerations, and strategic industrial policy converge. The discussions reflect a broader ambition to fortify domestic manufacturing, secure critical supply chains, and sustain U.S. advantage in the AI era—objectives that require sustained collaboration between industry leaders and policymakers.

At the same time, the policy environment—exemplified by export-control discussions with Nvidia and the complex questions surrounding leadership affiliations—illustrates the delicate balance policymakers are seeking between risk management and sustaining innovation. For Intel, the path forward involves not only addressing near-term operational challenges and cost pressures but also delivering a credible, long-term strategy that can restore momentum in core AI and data-center markets while reinforcing the nation’s competitive position in an increasingly contested technological arena. The outcome of these developments will influence Intel’s ability to attract investment, win customer confidence, and contribute meaningfully to a durable U.S. technology leadership narrative in the years to come.